Business Insurance in and around Bel Air

Get your Bel Air business covered, right here!

Helping insure small businesses since 1935

Your Search For Fantastic Small Business Insurance Ends Now.

As a business owner, you have to manage all areas of business, all the time. The details can be overwhelming! You can maximize your efforts by working with State Farm agent David O'Dea. David O'Dea gets where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Get your Bel Air business covered, right here!

Helping insure small businesses since 1935

Protect Your Future With State Farm

Whether you are an optician a piano tuner, or you own a bagel shop, State Farm may cover you. After all, we've been helping small businesses grow since 1935! State Farm agent David O'Dea can help you discover coverage that's right for you and your business. Your business policy can cover things such as business liability and loss of income and extra expense.

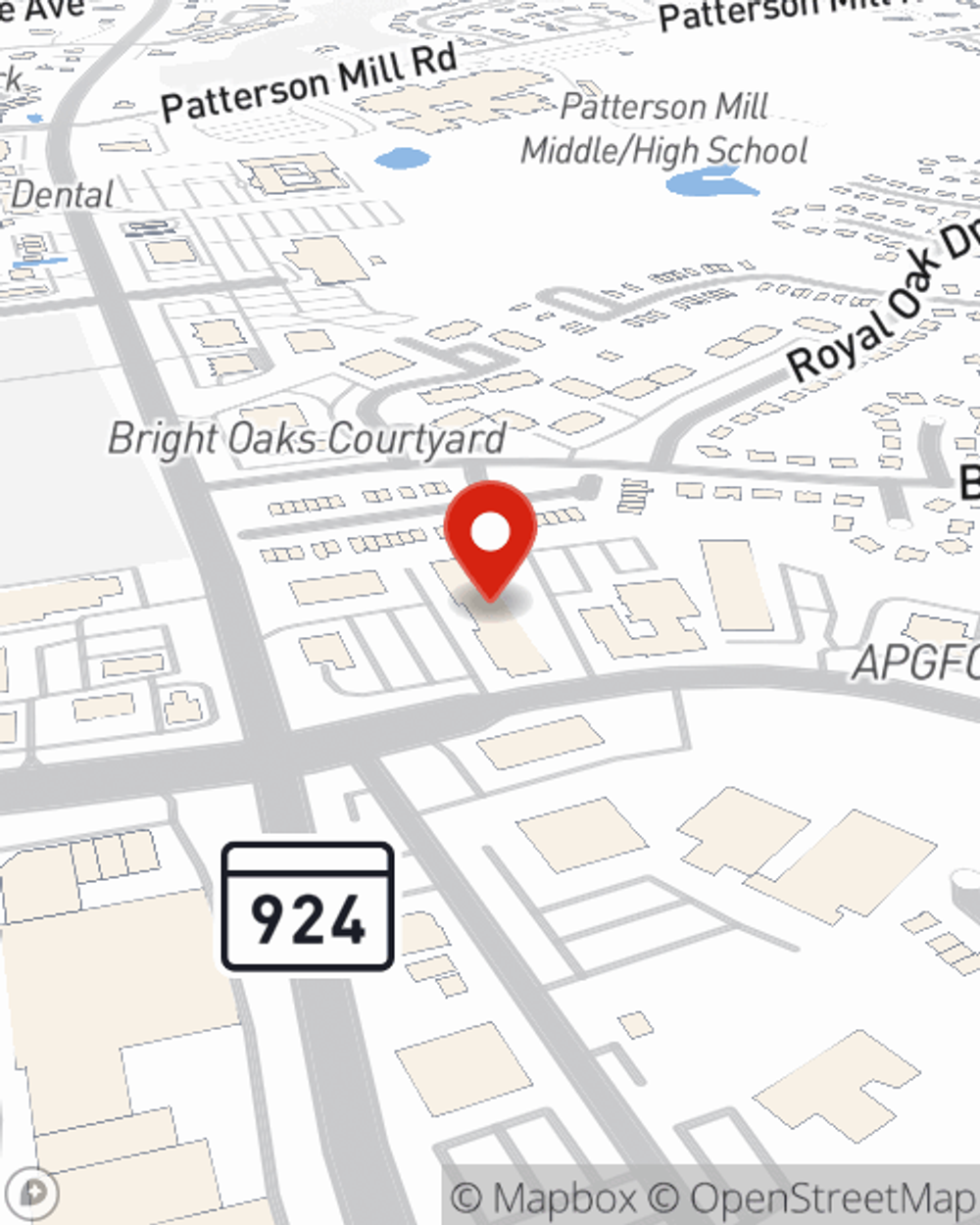

Call or email State Farm agent David O'Dea today to see how one of the leading providers of small business insurance can safeguard your future here in Bel Air, MD.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

David O'Dea

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.